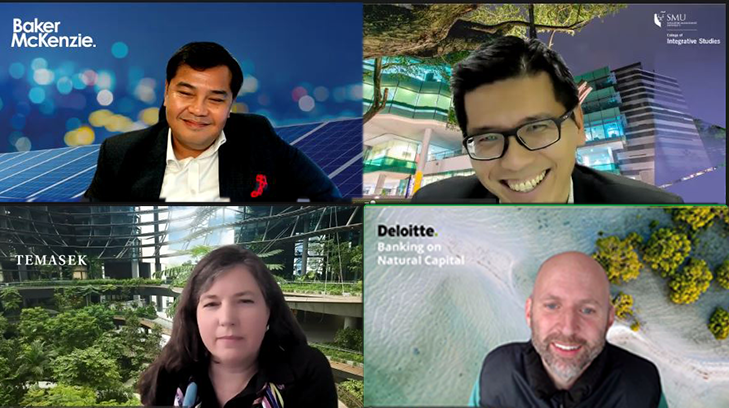

Top: Andrew Zaw, principal in the Finance & Projects Practice Group of Baker Mackenzie (left) and SMU Associate Professor of Urban Climate Winston Chow (right)

Bottom: Franziska Zimmermann, Director of Sustainability and Climate Change Strategy and ESG Investment Management at Temasek (left,) and Guy Williams, Nature Lead for Global and Asia at Deloitte Southeast Asia (right)

By Jana Quismundo

SMU Office of Research – With more reports of intense droughts, water scarcity, rising sea levels, increasing global temperatures and declining biodiversity, climate change continues to be an incredibly urgent issue global communities must work together to solve.

While natural factors contribute to climate change, scientists have shown that humans played a massive role in global warming over the past two centuries due to greenhouse gas (GHG) emissions. Setting goals and taking collective action to prevent and reverse these negative consequences was the focus of the 2022 United Nations (UN) Climate Change Conference (COP27) and the 2022 UN Biodiversity Conference (COP15).

At the Climate Governance Singapore (CGS) Panel Discussion on Insights from COP27 and COP15 held on 4 April 2023, climate and sustainability experts from academia and industry shared their insights regarding the recent COP events.

The panel included SMU Associate Professor of Urban Climate Winston Chow; Franziska Zimmermann, Director of Sustainability and Climate Change Strategy and ESG Investment Management at Temasek; and Guy Williams, Nature Lead for Global and Asia at Deloitte Southeast Asia. The event was moderated by Andrew Zaw, a principal in the Finance and Projects Practice Group of Baker Mackenzie.

The current climate situation

Professor Chow kicked off the panel discussion by recounting three key takeaways from COP27 that he believes were most significant, of which the highlight was the financial impact of climate change to the economy.

First, the private sector plays a huge role in implementing solutions and policies. According to a report published by the United Nations, roughly USD 5.9 trillion was spent on the fossil fuel industry in 2020. To achieve net zero – the cutting of greenhouse gas emissions to as close to zero as possible – by 2050, USD 5 trillion a year must be invested in renewable energy until 2030. As companies monitor their energy consumption and invest in renewable technology and infrastructure, they would be saving costs in the long run while bolstering the efforts of governments to protect the environment.

Second, the benefits of risk reduction in financing adaptation must not be ignored. When discussing climate change response, adaptation has largely been overshadowed by mitigation. Mitigation involves reducing climate change and lowering GHG emission into the atmosphere, while adaptation is adjusting to a life in a changing climate. The latter aims to reduce risks from the harmful effects of climate change and is necessary as the world heads towards a devastating 3 degree rise in average global temperature.

Finally, Professor Chow stated that “COP27 was contentious, but COP28 will be worse”. While many scientists and activists push for global action regarding climate change, they are countered by delay tactics from some nations and agencies. While there has been progress in reconciling these differences, there is still a long way to go and little time left.

Acknowledging the breadth of information that might make businesses uncertain about their climate policies, especially without a perfect data set, Professor Chow advises policymakers and companies to not “let perfect be the enemy of good.” With so many impending deadlines, doing something good right now matters more than doing something perfect when it’s too late.

The impact on businesses

Following Professor Chow’s takeaways, Zimmermann also shared her insights from COP27 – the first being a heightened sense of urgency and focus on action, and the second being the push for private sector accountability. She stressed that the steps to take regarding the climate issue right now need to go beyond goal setting. “Now, we need to accelerate action and companies need to heed the global call for accountability,” Zimmermann said.

Businesses were encouraged to see climate risk as an investment risk, as well as an investment opportunity. Zimmermann noted that investors are now interested in effective and sustainable forward-looking plans because capital is linked to the future of a company. Therefore, it is important to include climate risk in investment decision making.

Building on the other speakers’ thoughts, Williams shared his insights on COP15 which focused on biodiversity. COP15 asserted that focusing on GHG alone was not enough and that a wider view of nature must be considered. Fortunately, the work done regarding climate change is essentially the same work that needs to be done for nature with a broader framework. Emphasising the close link between climate and nature, Williams said, “there is no pathway to net zero without nature”.

It was also mentioned that a widely used statistic states that about 50 percent of the world’s GDP is highly dependent upon nature, but Williams argues that actually 100 percent of all the systems, businesses, sectors and geographies in the world are dependent upon it. It is then everyone’s responsibility to understand their footprint within nature since it affects us all.

In light of the insights from the panel discussion, it is clear that now is the time for urgent action regarding climate and nature issues, not only from the government but also across private sectors.

Singapore Management University is the Knowledge Partner of Climate Governance Singapore. Access the CGS knowledge hub on the Sim Kee Boon Institute at SMU website: https://skbi.smu.edu.sg/cgs.

Back to Research@SMU May 2023 Issue

See More News

Want to see more of SMU Research?

Sign up for Research@SMU e-newslettter to know more about our research and research-related events!

If you would like to remove yourself from all our mailing list, please visit https://eservices.smu.edu.sg/internet/DNC/Default.aspx