SINGAPORE, 16 January 2023

These are the research findings of the 46th round of the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

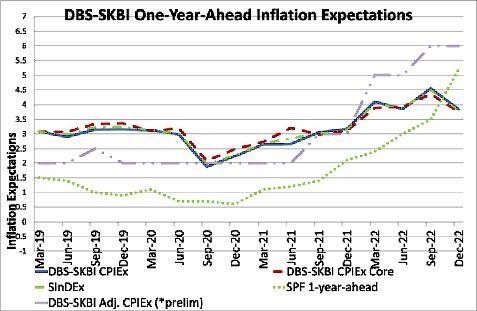

- One-year-Ahead headline inflation expectations fell to 3.8% in December 2022, from 4.6% in September 2022. This is a significant paring of inflation expectations from the 11-year high in September 2022. The fourth quarter one-year-ahead inflation expectations is still higher than the average one-year-ahead headline inflation expectations of 3.2% since inception in 2011.

- As a comparison benchmark, data from the Monetary Authority of Singapore Survey of Professional Forecasters (MAS SPF) released in December 2022 showed that the median forecasts of CPI-All Items inflation for 2023 was 5.2% and MAS Core inflation was 4.0%. The latest CPI data released from the Department of Statistics shows that CPI-All Items rose by 6.1% in January–November 2022, compared to the same period in 2021, with the latest November 2022 monthly inflation print coming in at 6.7% year on year. On 14 October 2022, MAS further tightened the monetary policy by re-centering the mid-point of the S$ nominal effective exchange rate (S$NEER) policy band up to its prevailing level. This was the fifth consecutive tightening move since October 2021. The October 2022 policy move, together with the previous monetary policy tightening moves, aims to slow the momentum of inflation and ensure medium-term price stability.

- The overall CPIEx Inflation Expectations, after adjusting for potential component-wise behavioural biases and re-combining across components, slightly increased to 6.4% in December 2022 from 5.7% in September 2022. Inflation expectations of all individual components also recorded some divergence in expectations. From September to December 2022, expectations of Food Inflation increased from 6% to 7%, housing and utilities increased from 5% to 7%, while healthcare inflation expectations miscellaneous components including personal care both rose from 5% to 6%. On the other hand, transportation inflation expectations dipped slightly to 7% from 8%. The remaining components inflation expectations including education, recreation & culture, household durables, clothing and footwear and communications remained steady at 5% between September and December 2022 surveys.

- We also observed that the free response overall inflation expectations after accommodating for potential behavioural biases remained unchanged at 6% in December 2022 compared to September 2022.

- In the December 2022 wave, continuing from June 2022 survey, we took a more forward-looking approach to analyse the impact of global economic developments on Singapore’s economic growth and inflation.

- Overall, given the global uncertainty, tightening of monetary policies and economic and geo-political disruptions, Singapore consumers felt that the pandemic will have a moderately negative impact on Singapore’s economic growth.

- Singapore consumers also felt that over the next 12 months, they will have to spend slightly higher amounts owing mainly to price increases despite possible cutbacks on consumption.

- In December 2022, we polled consumers for their sentiment about the overall inflation scenario over the next 12 months. Around 41% of those surveyed expect inflation to decrease while 45% felt that it will increase.

- The main reasons for reduction in inflation polled are slowdown in global growth (39%) and central banks in major economies raising interest rates (38.5%). Resolution of pandemic-induced supply chain disruptions are also expected to relieve price pressures. The main reasons cited by respondents for increase in inflation over the next 12 months were: central banks in major economies raising interest rates (30.5%), followed by geopolitical uncertainties due to the Russia-Ukraine conflict (25.8%) and higher demand due to relaxation of pandemic restrictions. Lingering supply chain disruptions account for about 13% of those who expect prices to go up.

- In the December 2022 survey, we found current economic conditions not to have a discernible impact on one-year-ahead and five-year-ahead inflation expectations except a slight negative price impact on transportation.

- There were however some divergences among respondents regarding the impact on inflation expectations for certain components including food, transportation, housing & utilities, healthcare, clothing & footwear, household durables & services, and overall one-year and five-year ahead inflation expectations where we find a distinct bimodal distributions, which means there are two large groups who disagree whether the impact would be positive or negative reflecting the global uncertainty.

- Following the academic work by Alberto Cavallo of Harvard Business School (2020) and the UK Office of National Statistics (ONS), respondents were asked if there were any substantive changes to their consumption basket. In the December 2022 survey, results indicate that respondents expect the consumptions baskets to remain unchanged over the next twelve months, signalling some normalisation of post-pandemic relative consumption and price patterns.

- Excluding expectations of accommodation and private transportation inflation, the One-year-Ahead CPIEx core inflation expectations in December 2022 survey declined to 3.8% from 4.4% in September 2022, in line with overall inflation expectations.

- For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations decreased to 3.6% in December 2022 from 4.6% in September 2022, in line with the drop in overall and core inflation expectations. This sub-sample measurement is potentially more representative than the full sample measurement, due to high home ownership and public transport ridership in Singapore.

- The core CPIEx Inflation Expectations (excluding accommodation and private road transportation expenses), after adjusting for potential component-wise behavioural biases and re-combining across components, increased to 6.1% in December 2022 from 5.5% in September 2022. The free response core CPIEx Inflation Expectations also increased to 6% in December 2022 from 5% in September 2022 poll.

- The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like accommodation, private road transport, food and energy related expenses polled at 3.8% in December 2022 from 4.5% in September 2022. It is significantly higher than the average of 3.2% since the survey’s inception in 2011 till 2021.

- In addition, in December 2022, around 10.8% of the Singaporeans polled expect a more than 5.0% reduction in salary in the next 12 months. This is a similar proportion compared to 10.2% in September 2022. The median salary increment expectation remained unchanged compared to September 2022 survey at an increase by 1.0%-5.0%.

Figure 1: One-year-Ahead inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components) One-year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDex) Survey conducted Dec 20-28, 2022.

Source: SKBI, SMU, MAS, Department of Statistics

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “After a year-plus period of high and rising prices, the global economy experienced a welcome respite toward the end of 2022 as energy and food prices corrected amid a general slowing of demand and improving supply side conditions. For Singapore, a widely-announced sales tax increase this year has been an additional source of information in forming expectations. Taking the survey results in totality, local inflation trends are largely reflecting global factors, with the ongoing respite, as welcome as it is, too little and too recent to suggest last year’s sharp inflation bout is conclusively over.”

SKBI Director, Professor Dave Fernandez commented, “The decline in inflation expectations between the third and fourth quarters of last year finally aligns Singapore with what households elsewhere are expecting. For example, in the US, the NY Fed survey has fallen by 1.8%-pts since peaking in June, and in Australia, the Melbourne Institute survey is down 0.9%-pts over the past five months. It bears watching closely whether 4Q was indeed an inflection point for inflation expectations in Singapore.”

SMU Assistant Professor of Finance and Founding Principal Investigator of the Quarterly DBS-SKBI SInDEx Project, Aurobindo Ghosh highlighted, “The World Bank Group in their Global Economic Prospects recently released in January 2023 have sharply adjusted global growth forecasts downwards to 1.7% in 2023, from earlier forecasts of 3%, citing elevated global inflation, higher interest rates, and other geopolitical tensions causing disruption and affecting investment. This elevated risk of a global downturn in the face of rising interest rate to tackle persistent inflation and cost of living is causing a ‘cognitive dissonance’ among both consumers and policy economists. Domestically, despite a forward guidance of a strong Singapore dollar by the Monetary Authority of Singapore, Singapore consumers are facing elevated price pressures from a tighter labour market, accommodation, utility, food costs and potentially a higher GST rate of 8%. However, a slowing growth forecast for major trading partners seem to dampen a faster growth in prices.”

“The divergence between the aggregated component-wise free response and the more structured questions might be attributable to behavioural biases that consumer response-based surveys like DBS-SKBI SInDEx surveys are susceptible to. To reduce the impact of such biases, the DBS-SKBI SInDEx survey provides some current and relevant aggregated information in the survey questionnaire developed by researchers at SMU and partners. However, heightened global economic uncertainty makes it challenging for Central Banks to anchor medium-term inflation expectations among economic participants. This is evident with 40% of survey respondents feeling that inflation will decline and 45% feeling that inflation will increase.” Prof Ghosh observed.

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations pared to 4.2% in the December 2022 survey from 4.7% in September 2022. The current polled number is still higher than the fourth quarter average of 4.0% since the survey’s inception in 2011 till 2021.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) also dropped to 4.1% in December 2022 from 4.7% in September 2022. Overall, the composite Five-year-Ahead SInDEx5 also declined to 4.1% in December 2022, from 4.7% in September 2022. In comparison, the fourth quarter average value (since the survey’s inception in 2011 till 2021) of the composite Five-year-Ahead SInDEx5 is 3.9%.

After adjusting for potential behavioural biases, the free response Five-Year-Ahead Headline Inflation Expectations declined slightly from 7% in September 2022 to 6% in December 2022. This signals that is some anchoring of long term inflation expectations despite the high degree of global geopolitical uncertainty and global economic headwinds.

“The long term five-year-ahead inflation expectations have moderated along with the medium term one-year-ahead inflation expectations. Furthermore, despite divergence in views in the medium-term inflation expectations, there is a more stable decline in long term inflation expectations raising the hope of more anchored or grounded inflation expectations to a new normal. Despite the advent of some new variants, a natural progression in a life cycle of a virus, there is more normalisation in an endemic Covid-19 world in the life vs livelihood debate where for every person choosing life over livelihood, about 4 choose livelihood over life, unchanged from September 2022 survey. Policymakers around the world seem to be treading more cautiously on curbing inflation to effect a ‘soft landing’ with policy normalisation amidst global headwinds for economic growth,” Prof Ghosh commented.

Press Release_DBS-SKBI_16Jan2023_FINAL.pdf

Originally published at https://news.smu.edu.sg/news/2023/01/16/headline-inflation-expectations-dipped-higher-interest-rates-and-global-headwinds

Back to Research@SMU February 2023 Issue

See More News

Want to see more of SMU Research?

Sign up for Research@SMU e-newslettter to know more about our research and research-related events!

If you would like to remove yourself from all our mailing list, please visit https://eservices.smu.edu.sg/internet/DNC/Default.aspx