SINGAPORE, 17 October 2022 (Monday)

These are the research findings of the 45th round of the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

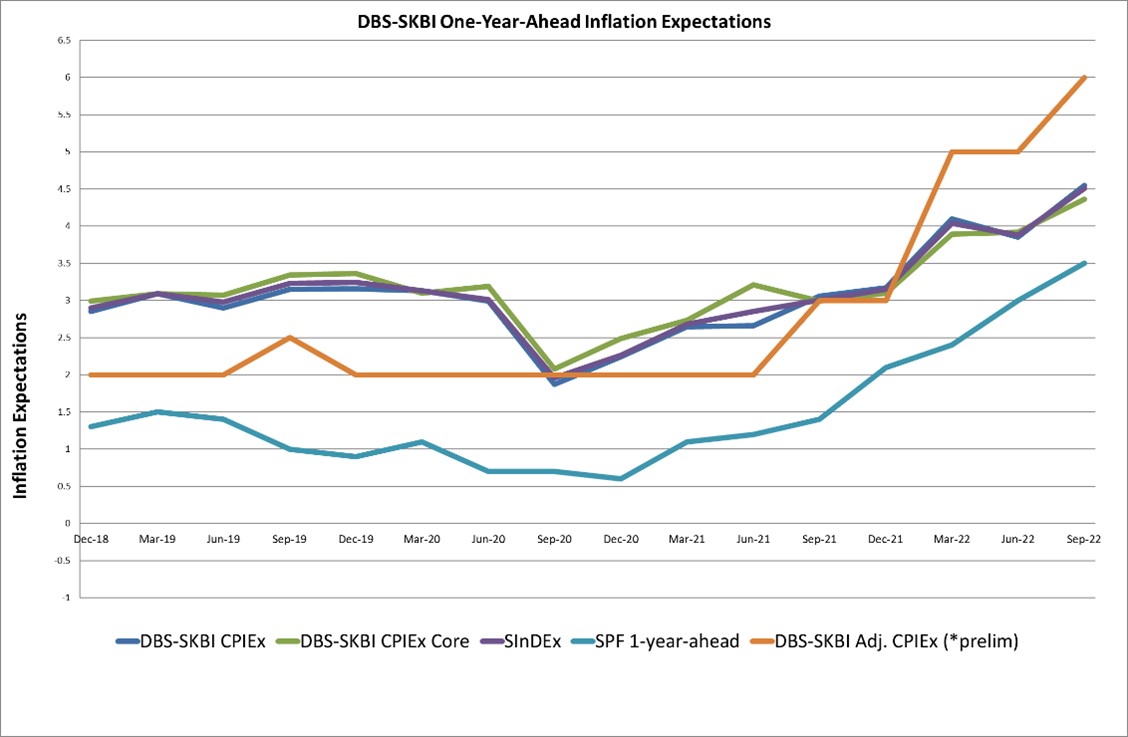

One-year-Ahead headline inflation expectations rose to 4.6% in September 2022, compared to 3.9% in June 2022. This is the highest recorded one-year-ahead inflation expectations since December 2011 when it polled at 4.6%. As expected, it is a higher reading than the historical (2012-2021) third quarter average of 3.18%.

As a comparison benchmark, data from the Monetary Authority of Singapore Survey of Professional Forecasters (MAS SPF) released in September 2022 showed that the median forecasts of CPI-All Items inflation for 2023 was 3.5% and MAS Core inflation was 3.1%. The latest CPI data release from the Department of Statistics showed that CPI-All Items rose by 5.7% in January–August 2022, compared to the same period in 2021, with the latest August 2022 monthly inflation print coming in at 7.5% year on year. On 14 October 2022, MAS further tightened monetary policy by re-centering the mid-point of the S$ nominal effective exchange rate (S$NEER) policy band up to its prevailing level. This was the fifth consecutive tightening move since October 2021. The October policy move, together with the previous monetary policy tightening moves, aims to slow the momentum of inflation and ensure medium-term price stability.

The overall CPIEx Inflation Expectations, after adjusting for potential component-wise behavioural biases and re-combining across components, slightly increased to 5.7% in September 2022 from 5.5% in June 2022. Inflation expectations of all individual components remained unchanged compared to the June 2022 survey at 5.0%, except the inflation expectations for Food increased to 6% in September 2022 survey from 5% in the June 2022 survey and that of Transportation remained unchanged at 8.0% from the June 2022 survey.

We also observed that the free response overall inflation expectations after accommodating for potential behavioral biases increased to 6% in September 2022 compared to 5.0% in June 2022. Consumer response-based surveys are susceptible to various behavioral biases unlike surveys given to professional economists like the MAS Survey of Professional Forecasters (SPF) who have more access to relevant and current information and research. To reduce the impact of such biases DBS-SKBI SInDEx survey provides some current and relevant aggregated information in the survey questionnaire developed by researchers at SMU and partners under the supervision of the Founding Principal Investigator, SMU Assistant Professor of Finance, Aurobindo Ghosh.

In the September 2022 wave, continuing from June 2022 survey, we took a more forward-looking approach to analyse the impact of global economic developments on Singapore’s economic growth and inflation.

Overall, despite policy stabilisation to alleviate the impact of the pandemic and its aftermath, given the global uncertainty and economic disruptions, Singaporean consumers felt that the pandemic will have a moderately negative impact on Singapore’s economic growth.

Singaporean consumers also felt they will have to fork out slightly higher amounts on spending owing mainly to price increases despite possible cutbacks on consumption.

Starting from September 2022, we asked consumers what they feel is the main reason for the general increase in prices. About 29.7% of consumers believe it is due to the impact of the ongoing Russia-Ukraine conflict, followed closely by supply chain disruptions (23.7%) and impact of Covid-19 easing measures (23.5%).

We found that the impact of the latest domestic and global developments on inflation expectations for Food, Transport, Housing and Utilities to be slightly negative towards increasing inflation.

In addition, the impact of the latest domestic and global developments on overall One-year-Ahead inflation and Five-year-Ahead inflation expectations was found to be negative but limited towards increasing inflation.

There is however some divergence among respondents regarding the impact on inflation expectations for certain components including food, clothing & footwear, and overall inflation expectations where we find a distinct bimodal distribution, which means there are two large groups who disagree whether the impact would be positive or negative reflecting the global uncertainty.

Following the academic work by Alberto Cavallo of Harvard Business School (2020) and the UK Office of National Statistics (ONS), respondents were asked if there were any substantive changes to their consumption basket. In September 2022, results indicate that a majority of components like Food, Transport, Housing and Utilities, Healthcare, Recreation and Culture, Household Durables and Services are expected to see limited increases. This indicates that in line with the increase in One-year-ahead inflation expectations, consumers expect their spending to rise slightly.

Excluding expectations of accommodation and private road transportation related inflation, the One-year-Ahead CPIEx core inflation expectations in September 2022 survey increased to 4.4 % from 3.9% in June 2022, in line with overall inflation expectations.

For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations increased to 4.6% in September 2022 from 3.8% in June 2022, in line with the change in overall and core inflation expectations. This sub-sample measurement is potentially more representative than the full sample measurement, due to high home ownership and public transport ridership in Singapore.

The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like accommodation, private road transport, food and energy related expenses polled at 4.5 in September 2022 from 4.0 % in June 2022. It is significantly higher than the average of 3.1% since the survey’s inception in 2012 till 2021.

In addition, around 10.2% of the Singaporeans polled expect a more than 5.0% reduction in salary in the next 12 months. This is a lower proportion compared to 11.5% in June 2022. The median salary increment expectation remained unchanged compared to June 2022 survey at an increase by 1.0%-5.0%.

Figure 1: One-year-Ahead inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components) One-Year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDex) Survey conducted Sep 12-20, 2022.

Source: SKBI, SMU, MAS, Department of Statistics

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “With the various measures ranging from 4 to 6%, ongoing developments with respect to inflation expectations are somewhat concerning. Through the course of this year, inflation expectations have risen considerably, in response to global price developments. Growth has already slowed in Singapore, but at the same time MAS is compelled to continue tightening monetary policy. Such tightening may be uncomfortable for many, but the regressive impact of high inflation is far more pernicious.”

SKBI Director, Professor Dave Fernandez commented, “The latest inflation data, including importantly the September CPI report in the US, continues to surprise on the upside, which is consistent with what inflation expectations surveys are showing. The September monthly surveys from the NY Fed saw 3-year and 5-year inflation expectations edge up, but 1-year expectations dropped, while in the University of Michigan survey, 5-year inflation expectations also fell. These contrast with our Singapore survey results, so it will be important to track if this US-Singapore divergence continues or if our surveys converge in the coming months.”

SMU Assistant Professor of Finance and Founding Principal Investigator of the DBS-SKBI SInDEx Project, Aurobindo Ghosh highlighted, “The International Monetary Fund (IMF) in their October 2022 World Economic Outlook highlighted the Cost-of-Living Crisis while projecting slower 2.7% global growth in 2023, their weakest forecast since 2001 barring global crises like the Global Financial Crisis and the peak of the COVID-19 pandemic. However, global inflation is forecast in 2023 to be 6.5% from 8.8% in 2022. DBS-SKBI Singapore Index of Inflation Expectations findings seem to be tracking the global outlook of uncertainty where Singaporean consumers expect a slight negative impact on growth, while overall inflation expectations have heightened since our last survey in June 2022. Both medium-term headline and core inflation expectations are the highest they have polled since December of 2011, nearly 11 years ago. In summary, we find that component-based inflation expectations show continued and persistently high values for food, transportation, housing and utilities. As households expect prices to continue rising, they are allocating an increasing share of their budget to spending on these components, consistent with academic work by Carvallo (2020) and UK Office of National Statistics (ONS).”

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations increased to 4.7% in the September 2022 survey from 4.5% in June 2022. The current polled number is higher than the third quarter average of 3.9% since the survey’s inception in 2012 till 2021.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) also increased to 4.7% in September 2022 from 4.3% in June 2022. Overall, the composite Five-year-Ahead SInDEx5 also rose to 4.7% in September 2022, from 4.4% in June 2022. In comparison, the third quarter average value (since the survey’s inception in 2012 till 2021) of the composite Five-year-Ahead SInDEx5 is 3.8%.

“The long term five-year-ahead inflation expectations have not increased as rapidly as the medium-term inflation expectations raising the hope of more anchored or grounded inflation expectations. There is more stabilisation in the life vs livelihood debate where for every person choosing life over livelihood, about 4 choose livelihood over life, higher compared to the June 2022 survey. This is signalling that we have approached a new normal of endemic Covid-19 and most advanced economies including Singapore are on a similar path to pursue non-inflationary growth despite challenging global macroeconomic conditions.” Prof Ghosh commented.

Press Release_DBS-SKBI_Sep2022_FINAL.pdf

Originally published at https://news.smu.edu.sg/news/2022/10/17/headline-inflation-expectations-elevated-11-year-highs-heightened-global

Back to Research@SMU November 2022 Issue

See More News

Want to see more of SMU Research?

Sign up for Research@SMU e-newslettter to know more about our research and research-related events!

If you would like to remove yourself from all our mailing list, please visit https://eservices.smu.edu.sg/internet/DNC/Default.aspx